is actblue donation tax deductible

ActBlue a platform that funnels donations from individuals to campaigns shows up hundreds of times on Democrats campaign finance filings. Contributions or gifts to ActBlue are not deductible as charitable contributions for.

Here are some key features and functions of the TEOS tool.

. Please join us with a tax-deductible donation. Donate to Community Chest or any approved Institution of a Public Character IPC before the year ends and enjoy tax deductions of 25 times the qualifying donation amount next tax season. The main ACLU is a nonprofit known as a 501 c 4 which has the ability to lobbying on behalf of its mission.

Regardless of whether a political contribution is made in the form of money or an in-kind donation it is not tax-deductible. However donations to ActBlue Charities and other registered 501 c 3 organizations are tax deductible. Contributions or gifts to ActBlue are not deductible as charitable contributions for.

Donations Tax Deductions. Tax deductible donations can reduce taxable income. How ActBlue Is Trying To Turn Small Donations Into A Blue Wave The liberal money-gathering platform is remaking fundraising for.

Theres just a 395 processing fee on all transactions. Select a state for small ActBlue donation totals in 2019 to Virginia. However in-kind donations of goods to qualified charities can be deductible in the same way as cash donations.

Once youre logged in you will immediately see the History page which. If you have any questions regarding your tax obligations you should consult with your own tax advisor. Donations to this entity dont count as tax deductible but you do become a card-carrying member of the ACLU.

COVID Tax Tip 2020-153 November 12 2020 Whether taxpayers are supporting natural disaster recovery COVID-19 pandemic aid or another cause thats personally meaningful to them their charitable donations may be tax deductible. Find out more about the different types of donations and their respective tax deductibility as well as how to claim these tax. These deductions basically reduce the amount of their taxable income.

Donors can use it to confirm that an organization is tax-exempt and eligible to. Americans for Financial Reform engages in legislative advocacy and these donations are not tax deductible as a charitable contribution. Contributions or gifts to ActBlue are not deductible as charitable contributions for.

The ACLUs dual structure is not unusual. Just the word donation can be misleading because only some contributions or donations are actually tax deductible. Duplicated download links may be due to resubmissions or amendments to an organizations.

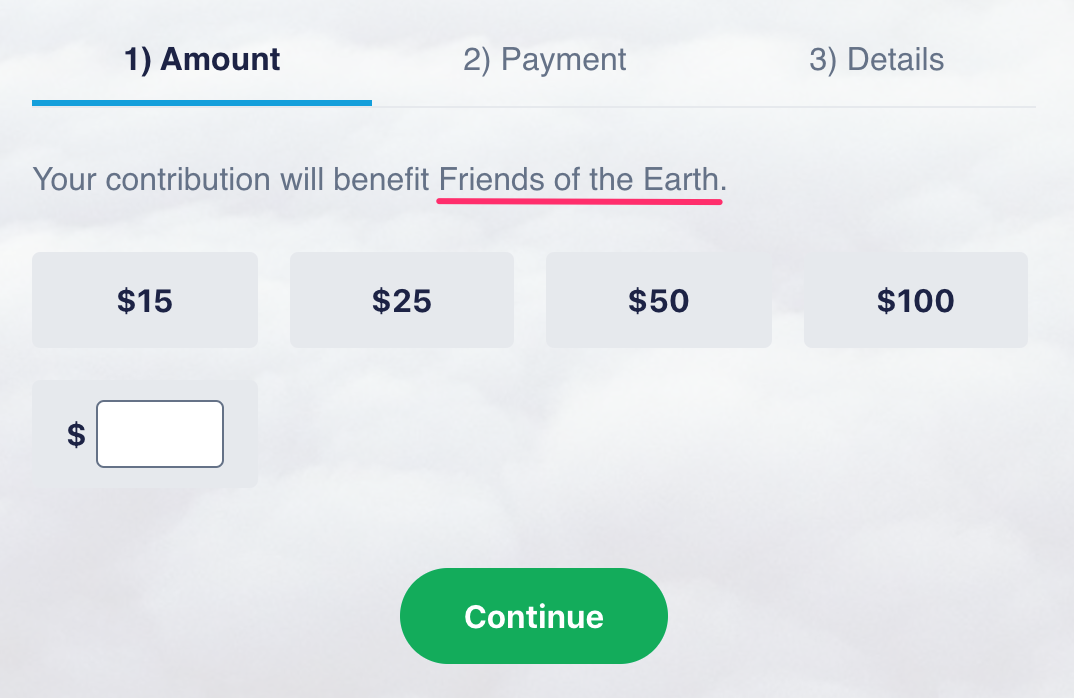

Tax deductible donations are contributions of money or goods to a tax-exempt organization such as a charity. Donations are processed by Actblue Charities and are tax-deductible. Typically deductible charitable contributions are those made to organizations that are tax-exempt under 501c3 of the Internal Revenue Code.

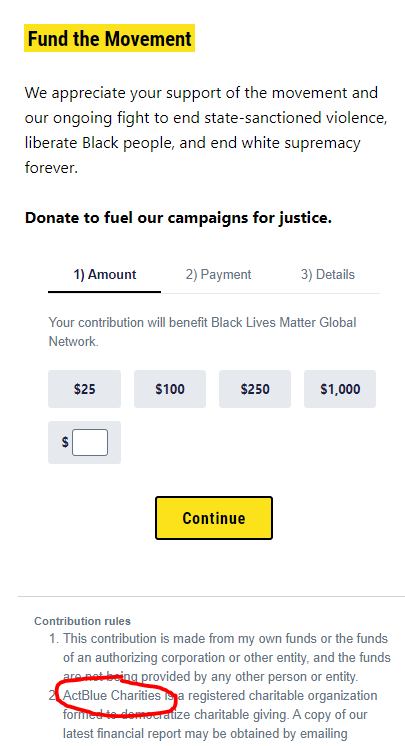

Contribution rules This contribution is made from my own funds or the funds of an authorizing corporation or other entity and the funds are not being provided by any other person or entity. Contributions or gifts to ActBlue are not deductible as charitable contributions for Federal income tax purposes. Some clues are provided by ActBlue a PAC that discloses the address of anyone who uses its online platform.

Will you make a tax-deductible donation today. The Coronavirus Tax Relief and Economic Impact Payments page provides information about tax help for taxpayers businesses tax-exempt organizations and others including health plans affected by coronavirus COVID-19. ActBlue Charities is ActBlues funding platform built specifically for 501c3 organizations which can receive tax-deductible contributions.

If your donation is accompanied by an experience perk the amount of your donation that is deductible for US. So far this year 37 cents of every 1 in small donations through ActBlue has come from outside Virginia. To claim tax deductible donations.

While political contributions arent tax-deductible many citizens still donate money time and effort to. If this organization has filed an amended return it may not be reflected in the data below. ActBlue Charities is a qualified 501c3 tax-exempt organization and donations are tax-deductible to the full extent allowed under the law Its website says.

1190 per personbusiness entity. ActBlue Charities is a qualified 501c3 tax-exempt organization and donations are tax-deductible to the full extent allowed under the law. Contribution rules ActBlue Civics is a registered charitable organization formed to democratize social welfare giving.

Theyre individual donations that have been processed through ActBlue. Drill down to maps showing cities and ZIP Codes. As a service it charges a transaction fee of 395 for each donation it receives and passes along to the final recipient.

Taxpayers can use this tool to determine if donations they make to an organization are tax-deductible charitable contributions. The IRS Form 990 is an annual information return that most organizations claiming federal tax-exempt status must file yearly. Contributions or gifts to ActBlue are not deductible as charitable contributions for.

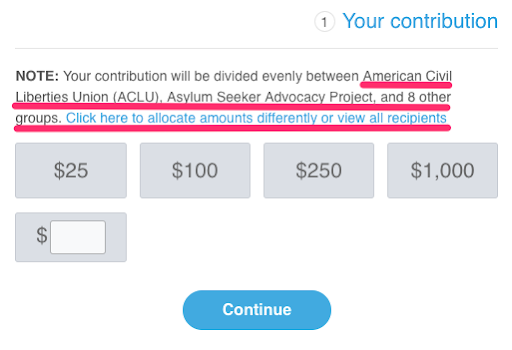

So donations via ActBlue are not PAC donations in the traditional sense. Read the IRS instructions for 990 forms. Tax Filings by Year.

This type of organization is specifically barred from attempting to. If you have an ActBlue Express account we make it easy for you to find your charitable contributions made through our platform. Federal income tax purposes may be limited to the excess of the amount contributed over the value of goods or services provided.

By proceeding with this transaction you agree to ActBlues terms conditions. This article generally explains the rules covering income tax deductions for charitable contributions by individuals. It provides information about an organizations federal tax status and filings.

At the bottom of the page it clearly states.

Are My Donations Tax Deductible Actblue Support

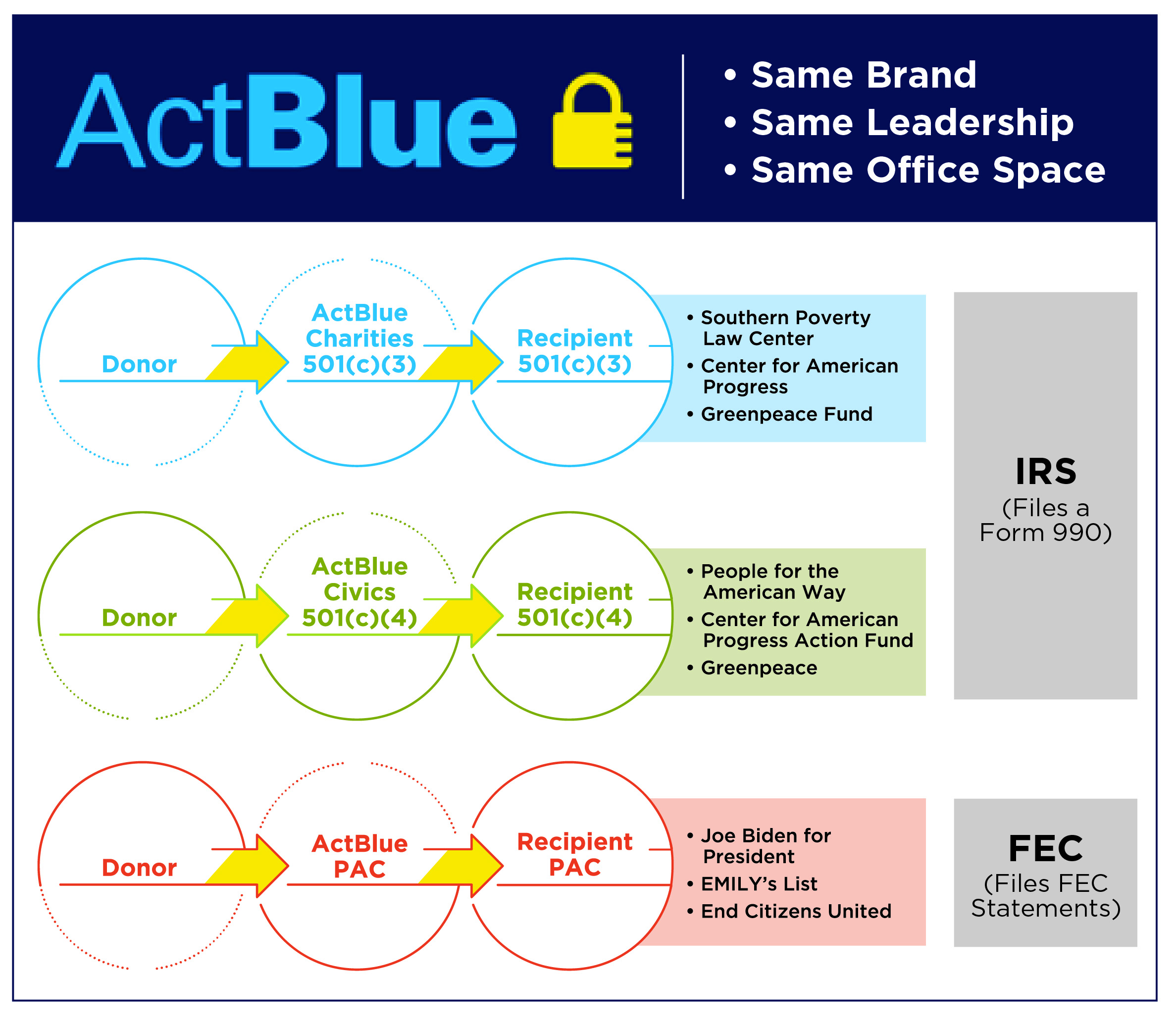

Actblue The Left S Favorite Dark Money Machine Capital Research Center

![]()

Are My Donations Tax Deductible Actblue Support

![]()

Are My Donations Tax Deductible Actblue Support

![]()

Are My Donations Tax Deductible Actblue Support

![]()

Are My Donations Tax Deductible Actblue Support

Are My Donations Tax Deductible Actblue Support

Are My Donations Tax Deductible Actblue Support

Are My Donations Tax Deductible Actblue Support

What Happens To My Money When I Donate Actblue Support

![]()

Are My Donations Tax Deductible Actblue Support

Actblue The Left S Favorite Dark Money Machine Capital Research Center

What The Hell Is Actblue And Why Is It Showing Up On So Many Democratic Candidates Campaign Finance Reports Minnpost

How Do I Change Or Cancel My Recurring Contribution Actblue Support

![]()

Are My Donations Tax Deductible Actblue Support

Actblue On Twitter Rajwebshar Jaffer22915438 Tulsigabbard Sure There S A 3 95 Processing Fee On Contributions Actblue Is A Nonprofit And We Don T Keep Any Part Of The Donation For Ourselves We Re Legally Required

I Donated To A Charity Through A Secure Actblue Com Link Where Does That Money Go Actblue Support